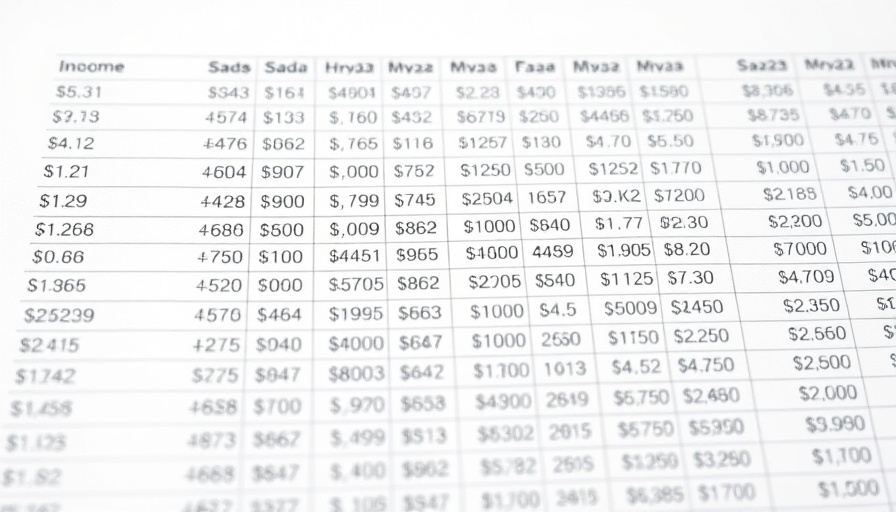

Insights from Lanny's May 2025 Dividend Income Summary

In the world of investing, understanding the nuances of dividend income is critical. May 2025 saw a noteworthy performance in dividend distributions, encapsulated in Lanny's monthly summary. For professionals focused on financial management, this summary serves as an essential touchpoint to gauge current market conditions and investment strategy effectiveness.

Understanding Dividend Growth in 2025

The trend of increasing dividends is essential for any investor aiming at consistent income. Lanny reported dividends from a variety of companies that are indicative of a broader market recovery since the volatility of the past few years. The importance of dividends cannot be overstated; they contribute significantly to overall return on investment (ROI) and asset performance. For instance, seasoned financial institutions are currently leaning towards dividend-paying stocks as a buffer against market fluctuations.

The Connection Between Economic Stability and Dividend Payments

The rise in dividends during May 2025 can also be viewed as a reflection of economic stability. Confidence in sustained growth leads companies to commit capital toward rewarding shareholders. This is crucial for financial professionals advising clients on wealth management. The balance between reinvesting earnings and distributing them as dividends demonstrates a company's financial health and strategic priorities. Monitoring these trends can offer invaluable insights for sound financial planning.

Investment Strategies: Navigating Through Dividend Stocks

Professionals in finance often consider the balance sheet of potential investments to make informed decisions. Companies significantly increasing dividends usually exhibit strong cash flow and a low loan-to-value ratio (LVR). Thus, examining these financial metrics is pivotal in ensuring that clients are investing wisely in stocks that not only offer dividends but do so sustainably.

Looking Ahead: Future Trends in Dividend Income

As we move forward in 2025, professionals can expect dividends to remain a focal point in investment strategies. Analysts predict that as inflation stabilizes and interest rates fluctuate, companies with robust dividend policies will continue gaining investor favor. This environment sets the stage for not just dividend income, but also for potential capital appreciation.

Practical Insights for Wealth Management Success

For financial consultants working with sophisticated clients, integrating dividend income into a diversified portfolio can enhance both cash flow and security. Understanding the trade-offs between high-dividend stocks and growth stocks enables a more tailored financial strategy. An advisor’s role in exploring various financial products—from insurance to banking services—while considering their impact on a client's total returns becomes critical.

Concluding Thoughts: Making the Most of Dividend Insights

Ultimately, as professionals continue to analyze Lanny’s May 2025 summary, the insights on dividend performance can empower informed decision-making. The fluctuating landscape of investments highlights the need for ongoing education and adjustment in strategies. Keeping clients informed on these developments, including effective financial advice and asset allocation, remains essential for success in the financial realm. By focusing on both macroeconomic trends and individual company performance, advisors can navigate the intricacies of financial markets effectively.

Add Row

Add Row  Add

Add

Write A Comment