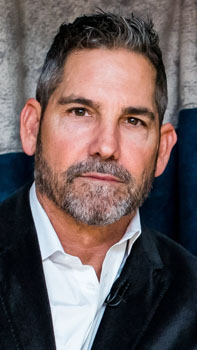

In this article, we will be talking about Grant Cardone. The real estate investor, sales guru and motivational speaker, was born on March 21, 1958, in Lake Charles, Louisiana, and was the fourth child of Curtis and Concetta Cardone.

Cardone graduated from LaGrange High School in 1976. He then attended McNeese State University until 1981, graduating with a Bachelor of Science degree in accounting. In 2010, he received the McNeese State University Distinguished Alumnus Award, an award for outstanding graduates.

After graduation, he became addicted to drugs and was in rehab twice. The counselor at the time told him that he was not going to be successful in his life. He was a drug addict due to the fact that he was unable to take on the loss of his father.

It got so bad that at one stage he was robbed and beaten by fellow addicts to within an inch of his life. After discharging himself from the hospital he somehow made it back to his mother’s house. She didn’t recognize him, so bad was the beating that he had taken.

His mother then made it clear that Grant was no longer welcome at her home, he was out of control. From this low point, Grant Cardone crawled back to redemption and signed up to rehab.

After rehab, he went after a job with a car sales business. The rest is history as they say, Pretty soon he was not only successful but went on to become the best car salesman in his business.

Grant Cardone – First Ventures

When he was 29, Grant bought his first house. It was a single-family home located in Houston, Texas. The initial rent managed to cover expenses however, it wasn’t long before Grant was seeking new tenants. After a negative experience, Cardone sold his investment as he believed it was not a good model to follow his investment philosophy.

In the following years, after he had saved enough money in order to build the base of his real estate empire, the businessman executed his first apartment purchase. After selling 38 properties within San Diego, he bought the property of a real estate agent for $1.9 million. He paid a minimal fee and within the space of a month, he had become proprietor of the 2nd building. In the following year, Grant bought the property at a cost in the region of $300 million. Real estate agents run by Cardone were also now based in several states. By the year 2012 Grant acquired five additional apartments.

Being experienced in investments, the owner of Cardone Acquisitions had most of the company’s shares and received support from the banks. Grant had now become a real estate magnate and the entrepreneur was considered by his contemporaries to be one of the top sales professionals on the planet.

The business rules outlined by Cardone are appropriate for people who are just starting out, as well as for those working in the field, tired sales managers, sales executives and brokers. The book he wrote, The 10X Rule: Only Difference Between Success and Failure, was considered one of the most inspirational books of all time. The entrepreneur’s bibliography over time has grown to eight books that are viewed by their target audience as a guide to taking action and being successful.

Cardone’s achievements marked him as an entrepreneur with an impeccable track record of success and a social media star. Grant hosted the TV show King Of Change, in which he acted as the coach to the entrepreneurs of small businesses.

Grant Cardone was now a respected businessman and best-selling author, and one of the most influential experts on real estate investment and the world of online business.

Grant Cardone – On Accumulating Wealth

Grant Cardone is a truly inspirational speaker. His thoughts on accumulating wealth are very forthright. When someone has dragged himself up from modest beginnings and overcome severe personal challenges, you have to respect his views and teachings.

An example would be his rules for fixing your personal wealth:

Grant Cardone’s 10 Rules To Get Your Money Right

- Don’t spend it until you get it.

- If you cheat on your money, you money will cheat on you.

- Save 40% until it’s time to invest it.

- If you can’t write it off, don’t buy it.

- Rent and lease. Don’t own.

- Stabilize and grow your first income flow.

- The 47 Rule: 40 hours for your boss/7 hours for you.

- Stay broke because cash is trash.

- You don’t want cash, you want cash flow.

- Never quit until you achieve your goals.

Here are Cardone’s 10 rules for a successful life

1. Don’t Let Fear Get In The Way

In his reflections on his professional career, Cardone says that regardless of how much money he earned the majority of the time, he was somewhat scared of it.

He was always worried about the loss of money or rethinking his thoughts and of being overwhelmed, or not knowing how to do with it.

One of the most significant lessons that he’s learned is the incredible power that fears have over you. It hinders you from reaching the fullest potential you have. The fear of failure can be especially toxic.

However, Cardone believes that failing is more difficult than achieving success. Overcoming your fear to put yourself in a position where you could fail, is the only way to put yourself in a position to win big. Fear of loss can be very inhibiting.

Cardone believes that life isn’t just about saving cash, becoming wealthy or building wealth. It’s about having the position to enjoy the freedom these things bring.

2. Don’t Be Afraid Of Debt

A lot of homeowners don’t become investors due to their fear of taking on debt. Their advice is to invest the next 30 years in paying back their house until they’re completely debt-free on their mortgage.

Cardone believes that these people are sitting on massive assets that aren’t being utilized.

Real estate is a great asset to assist in the repayment of the debt, that is, through its excellent cash flow to pay for the debt. The earnings from the property will be sufficient to cover the debt. You could then invest back into more property.

Let’s suppose you own five million dollars worth of property and have 3 million equity in the portfolio. Cardone suggests that equity should be used to invest, but also any cash being held in the bank.

3. Don’t Over-leverage

There’s a caveat in the second tip above. Cardone is comfortable keeping his credit to be at 65-70% the ratio of loan-to-value. This is his max.

In exceptional situations in which your cash flow seems great, on a home deal, the agent may increase the amount to 80 percent. However, generally speaking, 30 to 35 percent is the best most effective option according to him.

4. Re-invest Everything You Make

Cardone declares that he is a king of “nothing”. This guy could be snoozing on a yacht that is massive and not spending a single minute thinking about money. Instead, the money that he earns, he uses on purchasing more real property.

He believes that whichever amount you pay to the government as tax (about 40 percent in his case) you should invest the same amount to purchase the property.

Cardone will then spend his remaining 20% to continue living his life to the fullest. He considers that 20% an income that is passive. Cardone is often seen wearing a gorgeous watch, the Patek Philippe 40th anniversary timepiece. It’s worth about a hundred thousand dollars! The watch was bought by himself with the proceeds of one year of passive earnings, 20 percent. The following month? The next month? Back in the black.

5. Go Big Or Stay Home

Cardone believes that real property with a strong cash flow is essential to safeguarding your financial security. Cash flow is the king. However, for Cardone, the source of revenue isn’t sufficient therefore he wouldn’t purchase one unit. He’d want to buy the entire building.

“It’s the only thing you should be looking at,” says the billionaire.

He concentrates on one thing or one transaction. It could be 30 units or more. Buy the entire structure and don’t sell it to anyone else.

He likens this to a casino. If a casino was to open and only had one table it would be insane. Casinos are home to hundreds of tables that have numerous streams of revenue. The casino invests in the flow of cash.

Of course it isn’t everyone who is in a position to purchase an entire apartment. However, going as large as you can on your own is the best option.

6. Join Forces With Others

Cardone’s capital to start up for major real estate deals was derived from his successful business ventures. Not everyone has the ability to get started this way. If you’re not sure you can do it on your own then look for a partner.

Everyone would like to get into real property. Who has the time knowledge, expertise and funds to make it happen? Few. Contact these people and create an organization to finance the major deals.

Create a partnership that allows you both to win on the deal. A deal that they wouldn’t be able to get by themselves. Partnerships are powerful, therefore make the most of it.

What is the most important thing for Cardone? Give people respect and don’t be overly generous. Give your friends and family members a reward for their trust in you by caring for them.

7. Don’t Rely On ‘Customers’

While Cardone enjoys thinking big he only enjoys certain kinds of properties.

He isn’t a fan of hotels, since they are so reliant on the customers they serve. Nor of student housing is temporary in its nature. Students arrive but after they finish their studies they leave.

The point is that there’s an important distinction between making a big move and taking it risky. The biggest moves should be considered moves that rely as little as possible on the actions or whims of customers.

8. Commercial Is Risky

In the same way, Cardone thinks the commercial property is risky as the ways we work are shifting. Offices are shrinking due to businesses realizing that housing employees in one location is costly and inefficient.

It is only necessary to examine the hot-desking phenomenon that exploded in the last few years to see that companies have realized the value of floor space and how costly it is to waste. Nowadays, work-from-home arrangements are increasing as are shared work spaces. Cardone believes that we’re moving away from the office.

But what about homes? There will always be a need for places for people to live in.

9. Stop Repeating The Same Mistakes

Cardone’s 10X rule is built on the experience of 30 years of business mishaps.

What would Cardone consider to be one of his biggest errors? Cardone believes that the mistake was due to thinking too small. He was not playing with enough size and the lessons he learned from his error changed his mindset.

Prior to the incident, Cardone did all of the good things. He made use of his skills and was a hard worker. He kept his money. However, he was not making any progress.

When he made the decision to shake off his fears and put himself on the line and invest, he determined to maximize his investment and make big decisions.

Another wise observation on learning from mistakes is Cardone’s comment that he prefers to learn from others’ mistakes rather than from his own!

10. Give Back

Mister 10x states that ‘my life was saved by giving back, which is an amazing statement from a man who established an empire of business success. The meaning is that, by keeping his feet on the ground and being humble, he has remained true to his values as a person.

The Grant Cardone Foundation was an initiative that he started to raise funds to support a variety of causes, ranging from mentoring to financial literacy among the most disadvantaged and vulnerable people. He’s particularly passionate about helping children who’ve lost fathers like he did when he was just 10.

Grant Cardone is the very example of the success that has come from humble beginnings. With a shift in focus and implementing the rules that he’s put together from his own experiences, he’s created an impressive business and real estate empire. As usual, he’s not keeping his secrets to himself but sharing his expertise with the rest of us. We should be grateful for that.